MKESHO: Payment integration and automation

Payments

Challenge

MPESA was a blessing to kenyans and kenyan businesses. Soon enough it became an alternative defacto currency that had out grown its initial peer to peer vision. Equity Bank required automation of MPESA functionalities in the absence of an MPESA API.

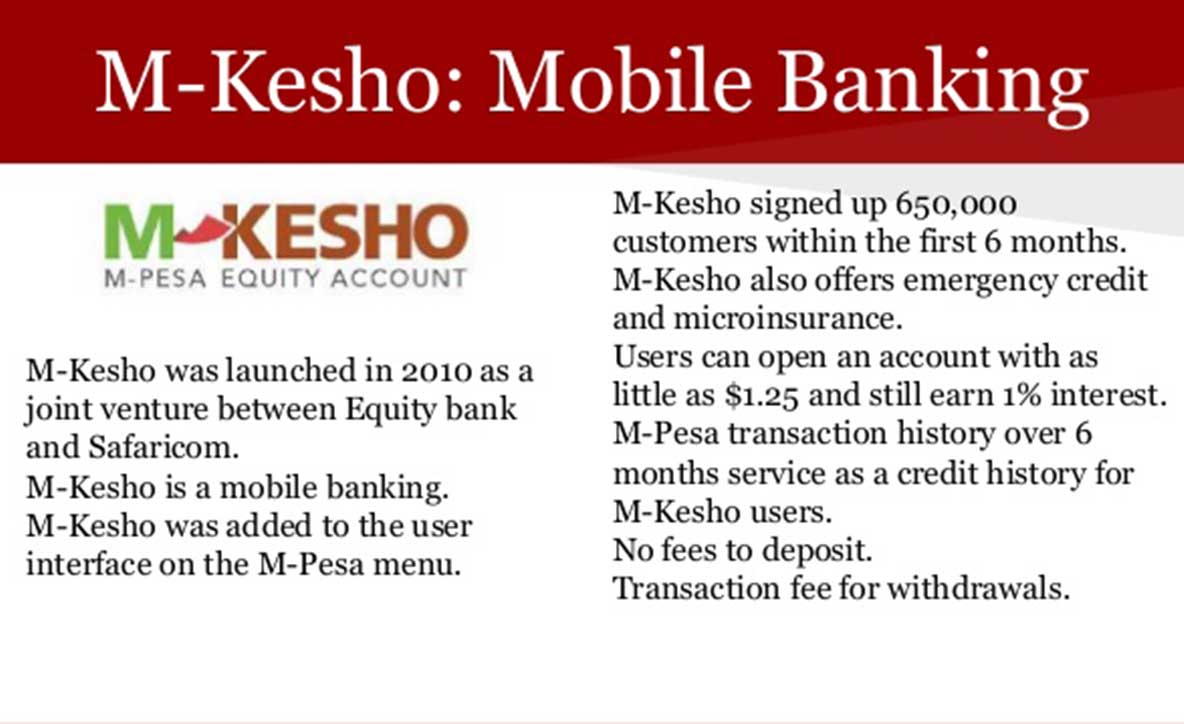

Project Goals

- Automate the disbursements and deposits of MPESA in the absence API integration

- Integrate payment transaction to the core banking system

- Deploy loan and savings services via a SIM toolkit application with Safaricom

Our Solution

Project "Ambata" (translated to "connect") was born with the need to offer mobile credit services. As part of that, there was a need to connect to safaricom and automate transactions without an API. Because MPESA APIs were non existant at the time, we used the existing MPESA portal. Using web robots or web drivers, we accurately and securely replicated the web process so as to automate and integrate disbursements to and from the core banking system

Results

We were able for the first time ever to handle over 2000 MPESA disbursements transactions per minute, from approximately 1000 every hour at best. This integration was ground breaking in ushering in numerous bank/mobile products and opening up MPESA to the business community in Kenya. It opened up the peer to business industry for MPESA

Get in touchHaving engaged a number of major software companies unsuccessfully, we didn't know how we were going to automate MPESA disbursements without an API. It was a member of the Zegetech team , Kariuki, who solved this enormous integration challenge, allowing us to roll out MKESHO and putting Equity Bank on the map as a ground breaking, mobile focused and innovative brand. We were first to market and we loved it.